call or text: (810) 292-4847

email: [email protected]

HTBS's operational times are as follows:

Sunday by appointment only, Monday through Thursday 9am to 9pm, and Friday 9am to 2pm.

In honor of the Appointed Times, HTBS will be closed on those seven festivals annually.

James and Tracy have decades of experience specializing in tax preparation, accounting, payroll, bookkeeping, and business consulting. With our hybrid business primarily remote, we provide premium service year-round anywhere you are.

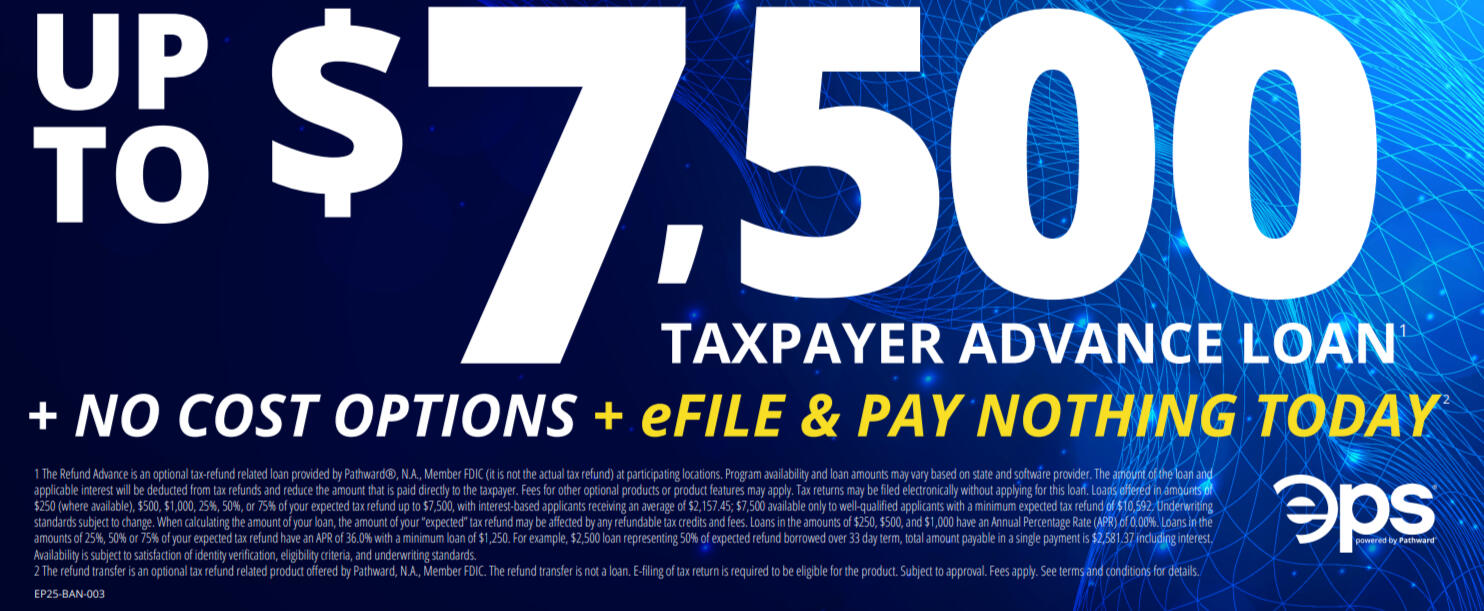

Income Taxes:

| Form | Description | price |

|---|---|---|

| 1040 1040SR 1040NR | Personal income tax preparation, includes all forms except the following... | $200 |

| 1040X | Amended US individual income tax return | $50 |

| Sch A | Itemized deductions | $100 |

| Sch C | Profit or Loss From Business (self-employed, gig work, side hustles) | $100 each |

| Sch E | Rentals (landlords), royalties, estates, trusts, etc | $100 per sets of 3 |

| Sch F | Profit or Loss From Farming | $100 each |

| 1065 | U.S. Return of Partnership Income | $300 |

| 1120 | U.S. Corporation Income Tax Return | $300 |

| 1120S | U.S. Income Tax Return for an S Corporation | $300 |

| 1041 | U.S. Income Tax Return for Estates and Trusts | $300 |

| 990 | Return of Organization Exempt From Income Tax | $300 |

| States | All except California, Maryland, New York, Oregon, Connecticut, Nevada, and Illinois | $50 each |

One hour free consultation by appointment only.

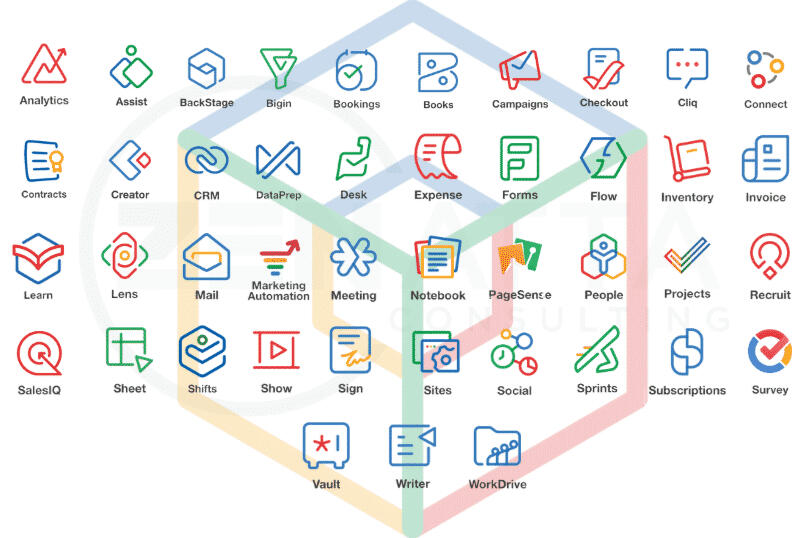

Business Services:

Business startup $200 + state fees

Website $500 per page

Payroll

Bookkeeping

Business plan

Business assessment

and more

Please review and share Thank you